What is FLARE?

Financial

Literacy

Advanced

Real-world

Education

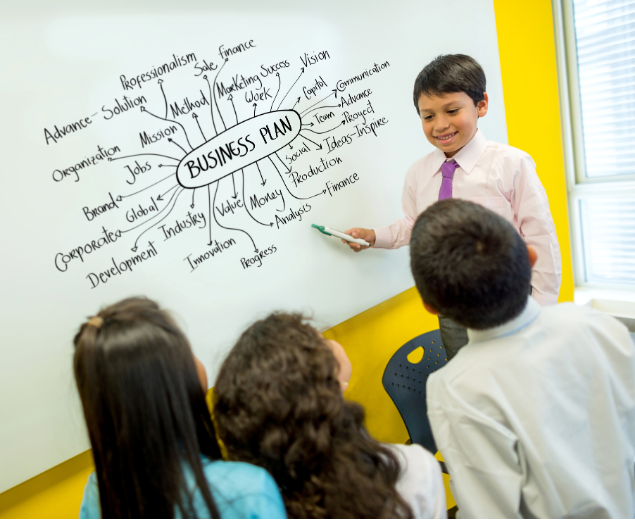

Offering the the Best Financial Literacy Program for Students in Kindergarten to Year 12

What is FLARE School ?

FLARE School aims to be

the guiding light in

school-based

Financial Literacy

& Advanced

Real-world Education

The Best Financial Literacy Program for Kids

AIMS

to enable students to develop a deeper understanding of financial literacy, entrepreneurship and business concepts

ALIGNS

with the Australian Curriculum by promoting creativity, critical thinking, problem-solving and decision-making skills

INTEGRATES

Bloom’s taxonomy to unlock critical and higher order thinking - FLARE THINKING

FOSTERS

responsible financial behaviour

EMBRACES

the United Nations’ Sustainable Development Goals

Modules

Designed to be delivered via 8 cross-curricular modules per school year

(2 modules per term)

How it Works

Weeks

Each module delivered over 6 weeks.

Flare School offers the best financial literacy program for kids in Australia, teaching money management, saving & investing in a fun way. Each week will build upon the previous one, allowing students to develop a deeper understanding of financial literacy and business concepts while promoting creativity and critical thinking.

HOW IS FINANCIAL LITERACY RELEVANT IN PRIMARY EDUCATION?

Many studies emphasise the

benefits of early exposure to

financial literacy, entrepreneurship and project-based learning.

A study by the University of Cambridge, commissioned by the UK’s Money Advice Service, found that basic money habits are formed by age 7 – this suggests that introducing financial literacy in primary school is crucial for establishing healthy financial behaviours later in life.

Research from the European Commission shows that entrepreneurship education in primary school helps develop key competencies such as creativity, initiative, problem-solving, critical thinking, risk-taking, resilience and leadership – skills that are both valuable for future entrepreneurs, as well as for broader personal and professional success.

The Organisation for Economic Co-operation and Development (OECD) highlights that students who receive financial education early are more likely to make informed financial decisions as adults – early education on concepts like saving, budgeting and understanding money can lead to better financial outcomes in adulthood.

WHY NOW?

The studies are clear - financially educating our kids is not just beneficial...it’s essential.

By equipping young minds with the tools to understand and manage money, we’re setting the foundation for a brighter future.

Empowering the Next Generation Through Financial Literacy

Imagine the impact

Communities thriving with empowered individuals who make informed financial decisions

An economy strengthened by ethical practices and widespread prosperity

A world where financial literacy is the cornerstone of opportunity and innovation

At FLARE School, we’re committed to this vision.

Together, we can inspire and educate the next generation to lead with confidence, integrity and financial wisdom – creating ripples of positive change that span the globe.

Let’s build a future of prosperity, one student at a time.

Enroll your school now and be part of the movement.

Flare School launches in 2025 with an exclusive pilot program focused on empowering students with essential financial literacy and entrepreneurial skills.

Available to a select number of schools, this world-first program offers a unique opportunity to equip the next generation with real-world financial knowledge.

Register Now for your school’s chance to participate in this groundbreaking pilot!